how to answer are you exempt from federal withholding

Also claiming several dependents. How to answer are you exempt from federal withholding Wednesday June 8 2022 Edit.

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

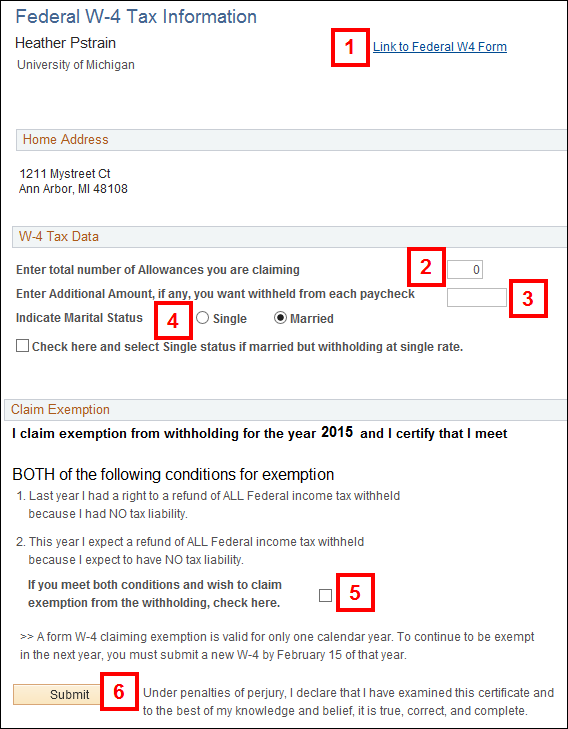

Select Payroll Info and then select Taxes.

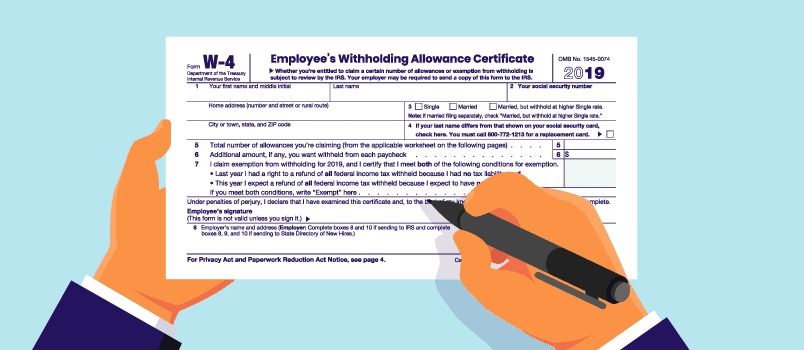

. To claim exemption from withholding write exempt on your W-4 in the space below Step 4c. Even if you qualify for. Fill out a new Form W-4 to resume withholding federal tax.

Your child may be exempt from income tax withholding if in both the prior year and the current tax year the teen owes no federal income tax. On the form youll enter your personal information. To be exempt from withholding both of the following must be true.

This interview will help you determine if your wages are exempt from federal income tax withholding. Your child may be exempt from income tax withholding if in both the prior year and the current tax year the teen owes no federal income tax. You expect to owe no federal income tax in the.

Until the employee furnishes a new Form W-4 the employer must withhold from the employee as from a single person. You owed no federal income tax in the prior tax year and. When you claim certain deductions they get.

If you want to claim exemption from withholding you need to fill out a new Form W-4 and submit it to your employer. It is possible to do so and many taxpayers do so throughout the year. Your tax bill will not be postponed as a result.

Employees if they qualify may be exempt from. You owed no federal income tax in the prior tax year and What is a federal tax withholding exemption. To be exempt from withholding both of the following must be true.

When you want to claim exemption you must once again file a Form W-4. Correct answer For example for the 2020 tax year 2021 if youre single under the age of 65 and your yearly. Information Youll Need Information about your prior year income a.

Correct answer Who Is Exempt From Federal Income Tax. From the Federal tab on the W-4 Form dropdown select the applicable form. Select the employee you want to exempt.

Being exempt from federal withholding means your employer will not withhold federal income tax from your paycheck. Withholding is amounts taken from an employees pay by the employer for state and federal income and other taxes. If however a prior Form W-4 is in effect for the employee.

You may then owe tax and face a penalty when you file your return.

3 Ways To File As Exempt On A W4 Wikihow

How To Know If I Am Exempt From Federal Tax Withholding Sdg Accountants

:max_bytes(150000):strip_icc()/TermDefinitions_Incometax_finalv1-2c3f527bde3a41c296b6389fda05101d.png)

What Is Income Tax And How Are Different Types Calculated

W 4 Form Guide How To Change Your Tax Outcome Taxact Blog

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

1040 2021 Internal Revenue Service

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

.png)

Form W 9 What Is It And How Is It Used Turbotax Tax Tips Videos

![]()

Going Exempt A K A Not Having A Withholding For Your Income Tax

How Do I Know If I Am Exempt From Federal Withholding

How To Fill Out A W4 2022 W4 Guide Gusto

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-V1-6455aa5186fe4122b592a2accb6b8f73.png)

Withholding Tax Explained Types And How It S Calculated

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate

How To Fill Out Your Tax Return Like A Pro The New York Times

How Is Tax Liability Calculated Common Tax Questions Answered

Am I Exempt From Federal Withholding Do I Still Get A Refund Gobankingrates